413 944 0009

Reverse Splits News - Nov 2024

Nathan Pearce

Lots of news to happen to Reverse Split Arbitrage ("RSA") strategy in the last two months. I am going to share key points. If you really can't read all this story, scroll to the end, or click here TL;DR

There are more people using this RSA than just us. I'm in a group, and there are clearly other groups of users using this methodology to make money. A few of the other private RSA strategy groups started to automate both account creation and trading, and went absolutely NUTS, opening 100 accounts per person on a brokerage called "TRADIER" alone.. let along others they may have automated.

TRADIER specifically offered "API" access to their systems, to automate trades, but probably never planned for a profit model that rather than buying and selling lots of shares, people were profiting off having lots of ACCOUNTS... These automated sells would all trigger a sell on the post-split stock at 9:30am at market open, likely causing their systems usage to spike. These spikes in volume got the attention of three companies who all issued press releases claiming "manipulation" and promising investigations:

VERB MOVE & UPXIAMIX updated the SEC stating that pre-split, they claimed they had "around 4,800" shareholders of record, and that post-split, brokers told them they needed to issue 271,846 shares to round up all the shareholders. This roughly means that 265,000 accounts suddenly bought at least 1 share pre split? That's pretty noticable. So noticable in fact, that the UPXI letter got a write up in Bloomberg, which is read by basically every financial trader, so now everyone in the industry knows this method exists.

“Great, they finally figured out how to use this method to maximize profits” is what you might be thinking… The problem is that when we trade a stock about to reverse split, it takes days, even weeks for the actual company to “hand out the rounded-up shares of stock” to all the brokerages.

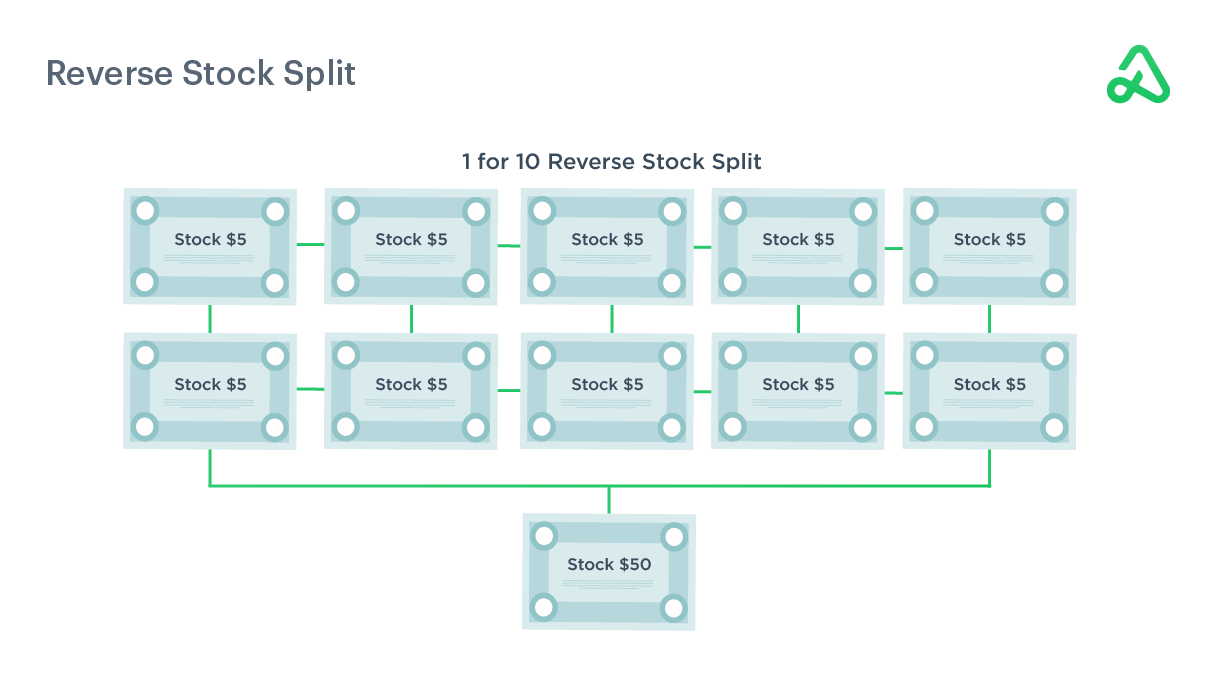

**Example**: A fifty cent stock reverse splits, and rounds up.

We turn $0.50 into $10, and we sell at $10 …

Issue 1 : and then the stock drops to $6 before the share is actually given to the broker,

the market says the broker sold it for $10, the buyer paid $10, but the broker sold

essentially a made-up share that didn't exist, and only can deliver it once it arrives.

Issue 2: All these keeping track of trades and made ups that are sold has to cost the broker

in record keeping people and systems, surely.

Of course, neither might happen, and their loss or gain is somewhere randomly in the middle, so, mostly this is a wash, but too many of these deals being abused in the 100’s per person means a group of only 20 people doing this x100 costs 2000 x $4, or $8,000 for the broker...

So, in the end, this strategy is really available to us because the industry moved to $0 commissions on trades, and didn't put up roadblocks. Otherwise, paying $6.95 or more like in the old days of trading pre 2019 would have never seen this as viable.

To Summize, TRADIER broker has elected to no longer permit this kind of trading activity, electing to:

Prevent purchase of stocks that have announced they are about to undergo a reverse split Up their "re-organization fee" of stocks that undergo a reverse split to $35 per stock

Other brokers have already done this, and this is a shame for us making small dollars off the market like this, but you are better off forewarned and forearmed than not knowing this.

If all that was Too Long; and you Didn't Read it, at least read this:

TL;DR

If you're worried, only do reverse splits via brokerage companies you can afford to have all business halted with.

Consider leaving your profits in your account, and actively buying safe stocks or index funds with them, to be seen as a "Real Investor" and not a "profiteer".

(so dumb that us little guys have to consider acting like this vs Wall St.) Don't create any more than two accounts of one type at any one brokerage.

EG: Two "Individual Investing (personal)" accounts.

+ Two "IRA" accounts.(Types of accounts might include: Personal Investing, Joint Investing, IRA, Roth IRA, 401k, 529 investment) Keep it reasonable per broker. This likely means 4-5 accounts per broker.

(I'm not really any any higher than 3 anywhere)Open any extra accounts slowly.

Don't bother the brokers if a round up doesn't go your way. If you need to call them to sell of a partial share, don't go into depth about how you got it, just call them and say,

"Hey, I need you to sell a partial share in my account" Like #1 above, Don't Do Reverse Splits in your 401k, or with your broker that holds your 401k.

If you have questions, you know me, you can ask.